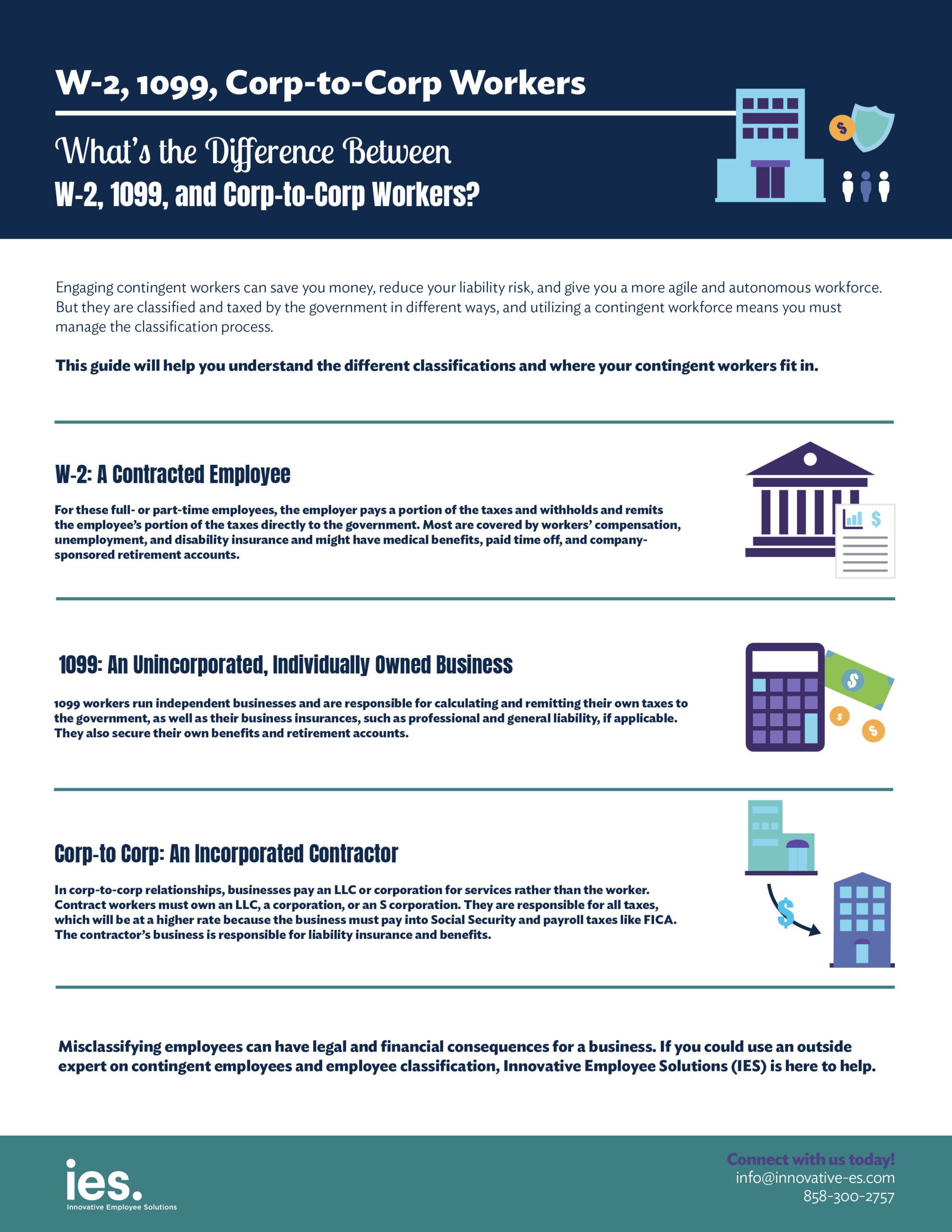

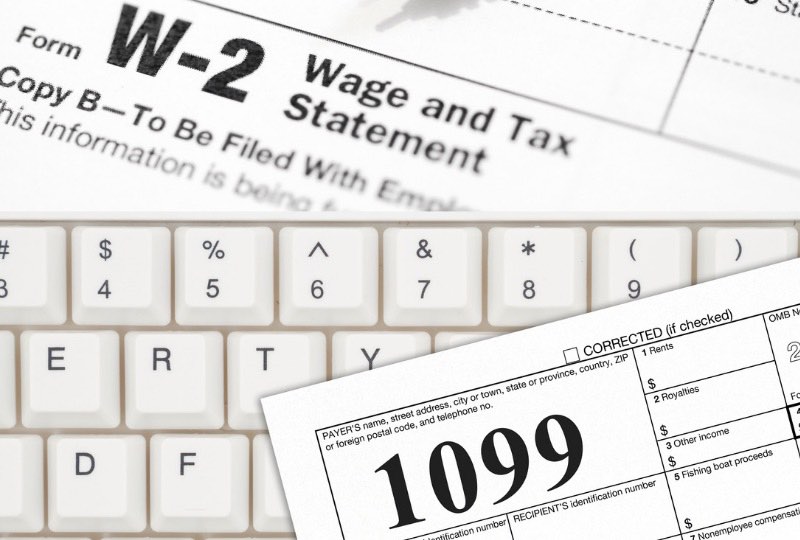

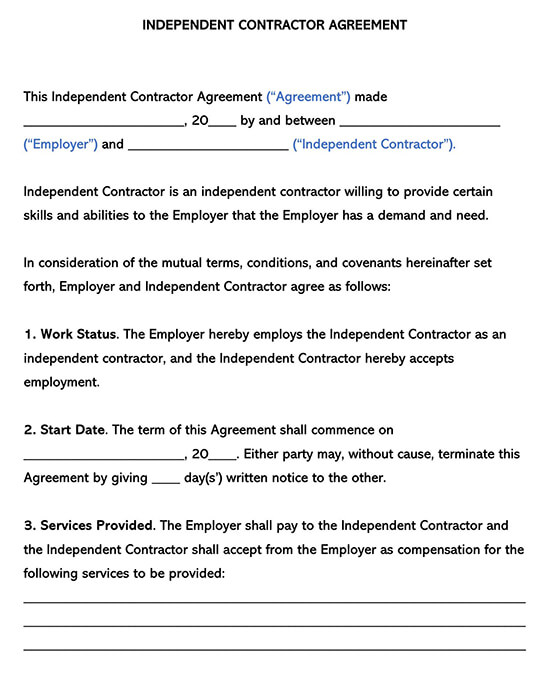

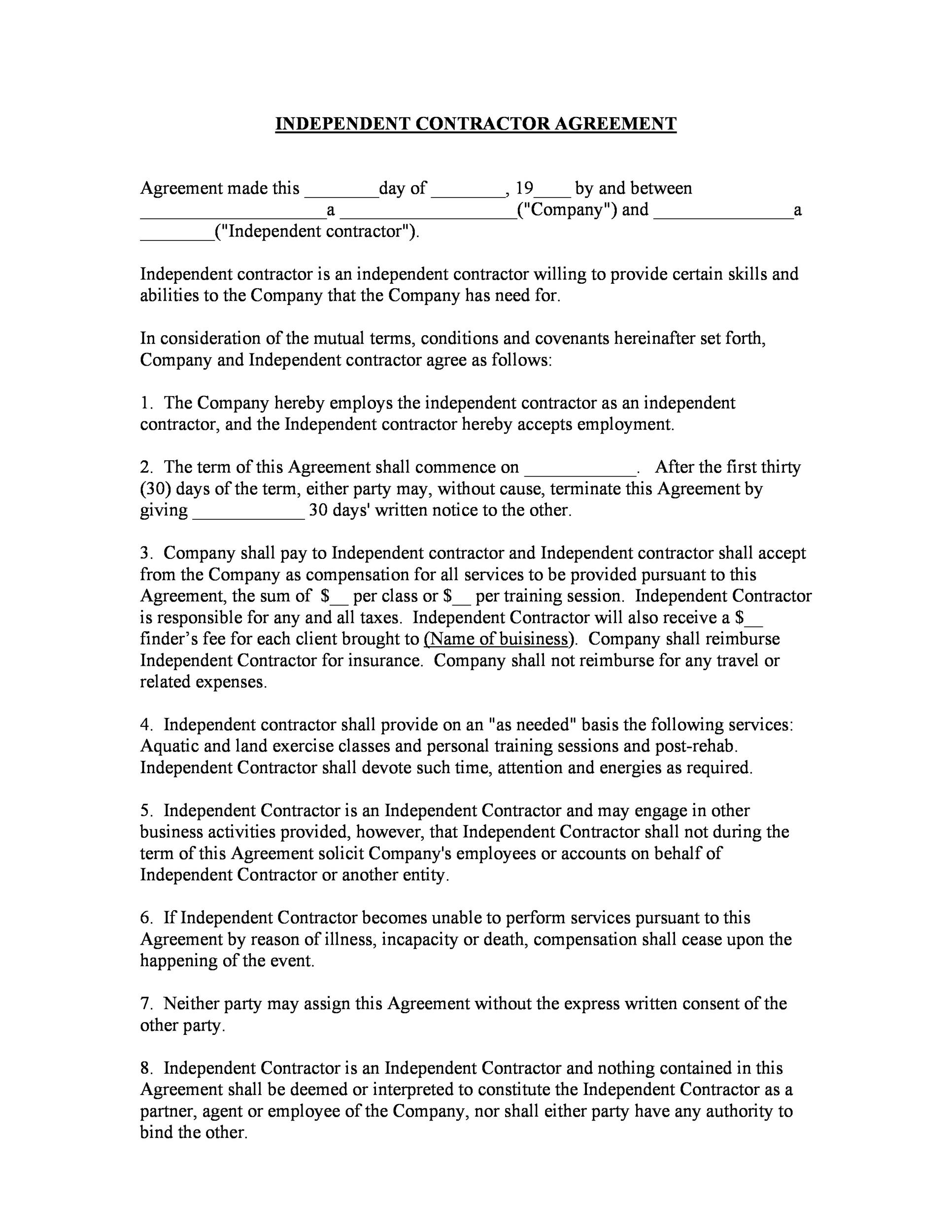

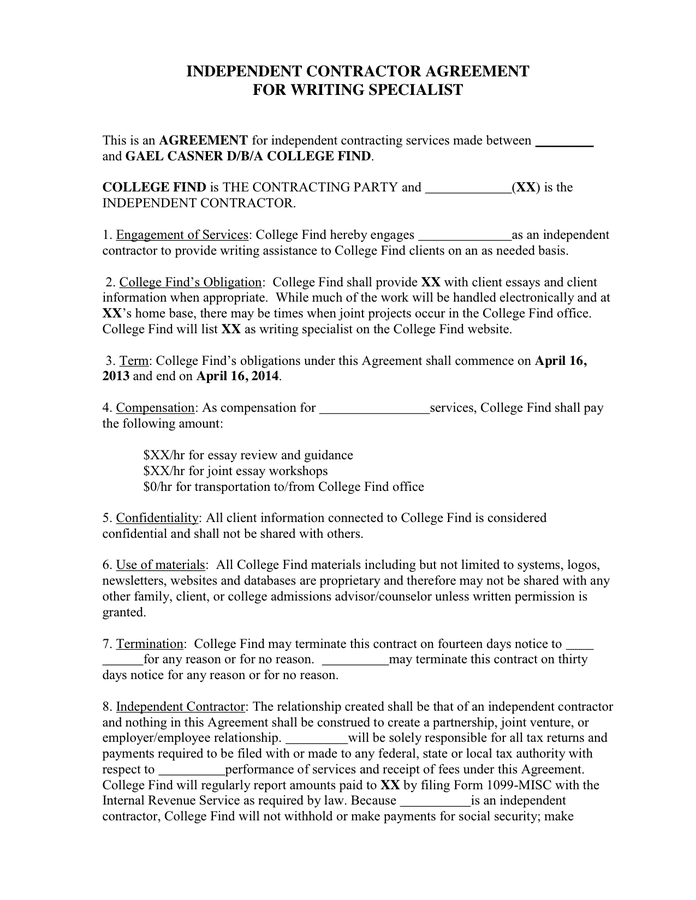

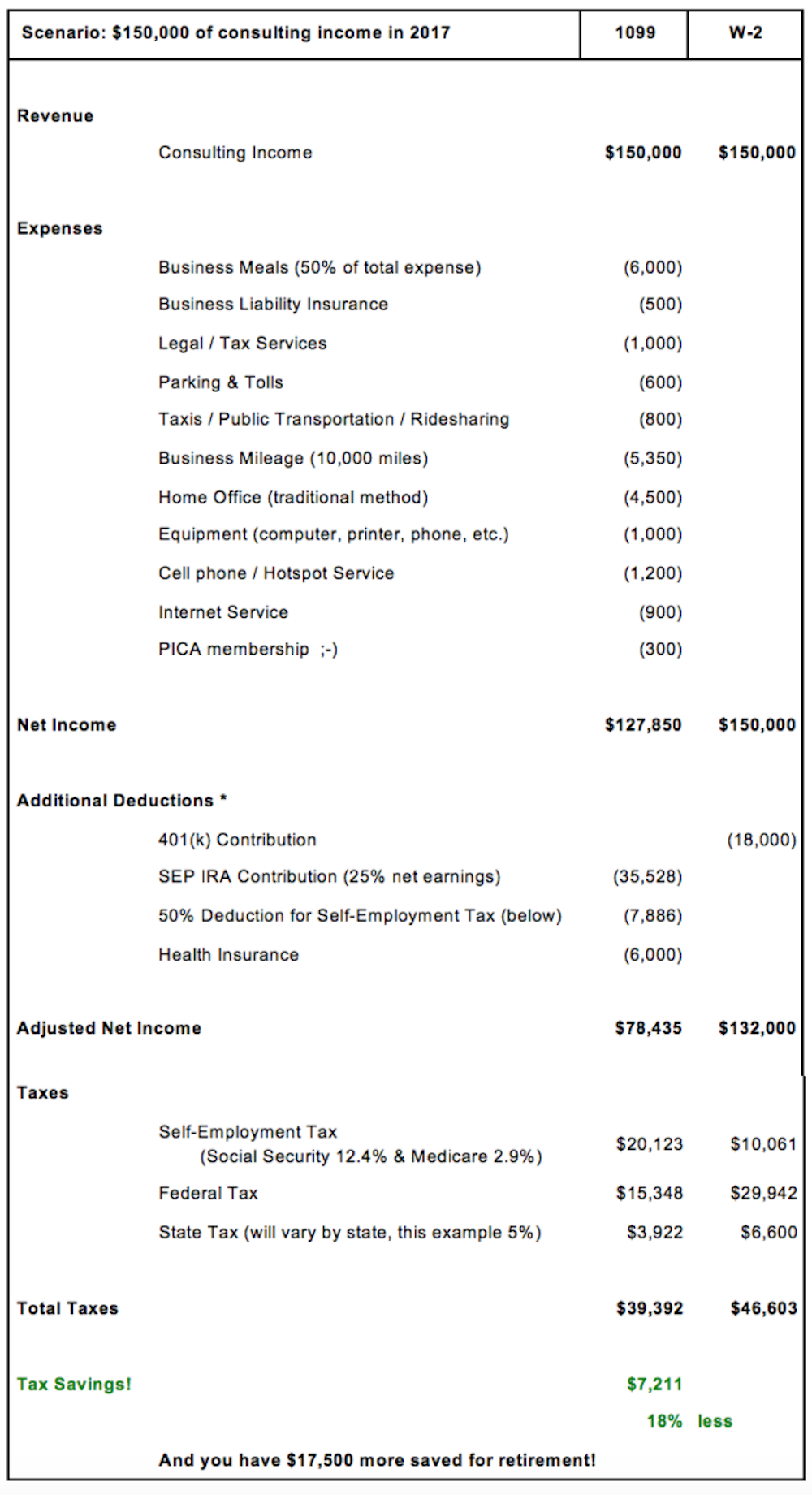

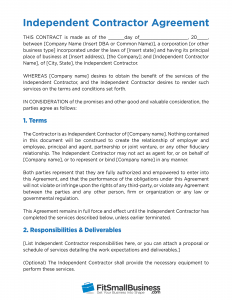

Independent Contractor is an independent contractor willing to provide certain skills and abilities to the Employer that the Employer has a demand and need In consideration of the mutual terms, conditions, and covenants hereinafter set forth, Employer Contractors don't earn benefits or have taxes withheld from their wages, and at the end of the year you'll receiving a 1099 instead of a W2, so sometimes people refer to contracting work as a 1099 1099 and W2s are the different tax forms used to deduct payroll taxes on different types of employees 1099 employees are selfemployed independent contractors They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return A W2 employee receives a regular wage and employee benefits

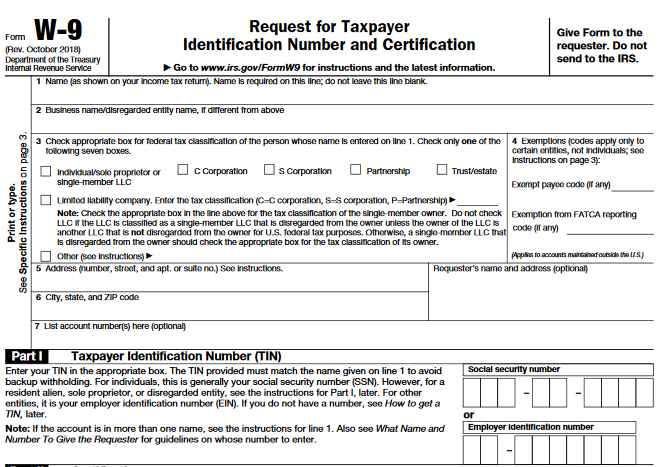

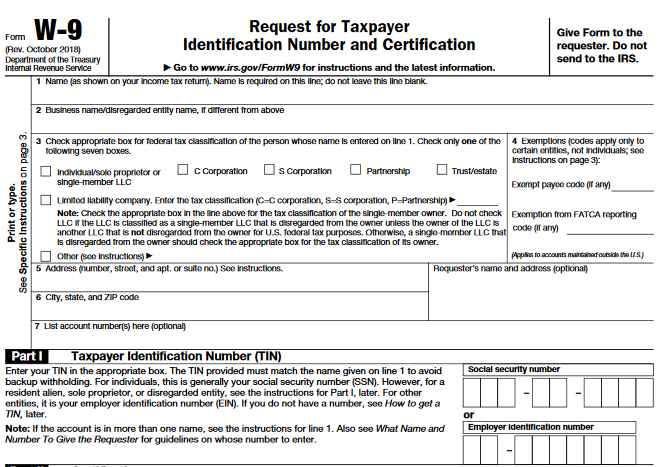

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

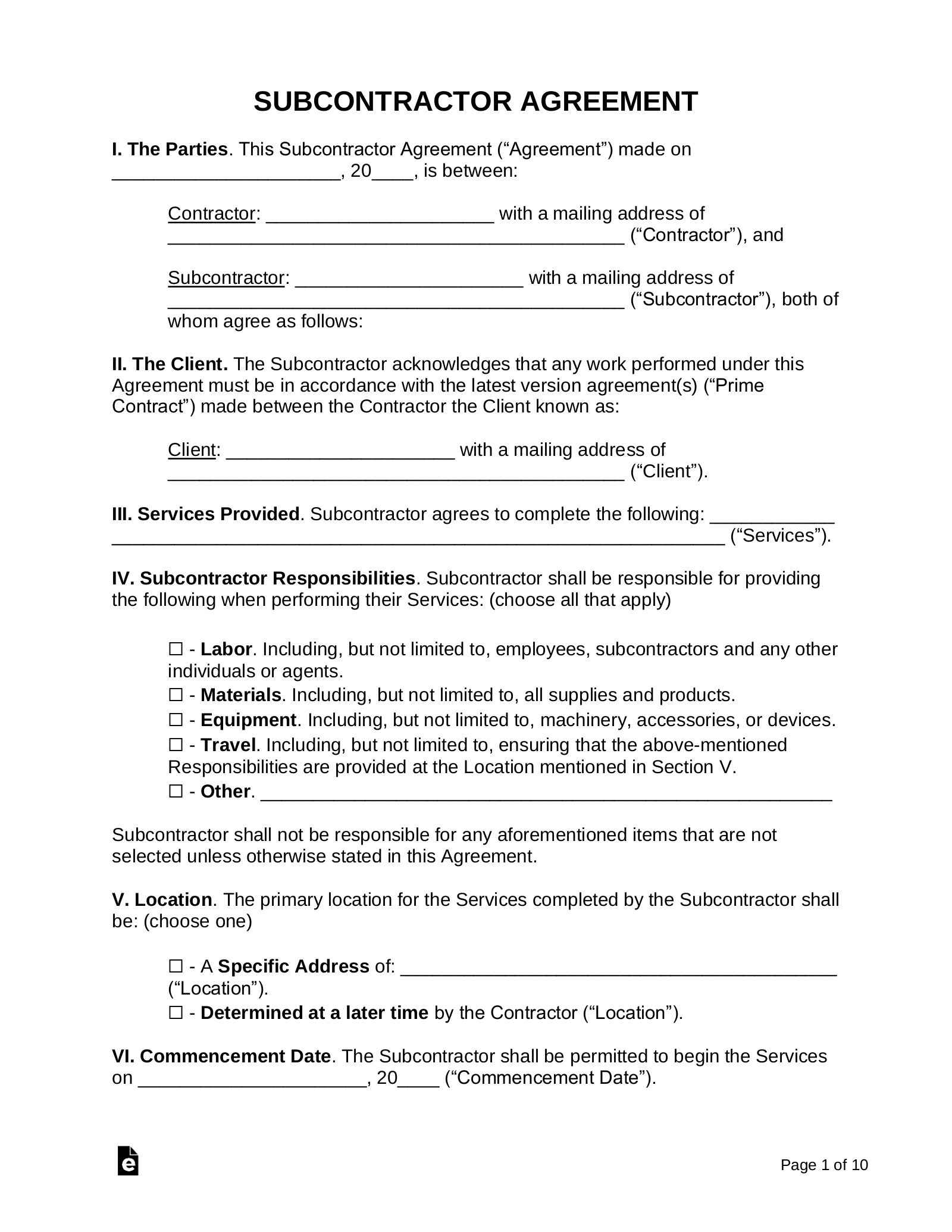

1099 contract template

1099 contract template- Pros and Cons of Working as a 1099 Contractor Before you decide to accept an offer to work 1099, consider the pros and cons Pros If you elect for 1099 employment with an employer or a client you are doing contract work for there are some definite positives First, 1099 contractors get to set their own rates within reasonA 1099 contractor, also known as an independent contractor, is a classification assigned to certain US workers The "1099" reference identifies the tax form that businesses must file with the Internal Revenue Service , and it relieves the employer from the responsibility of withholding taxes from the individual's paychecks Although independent contractors provide a service to an

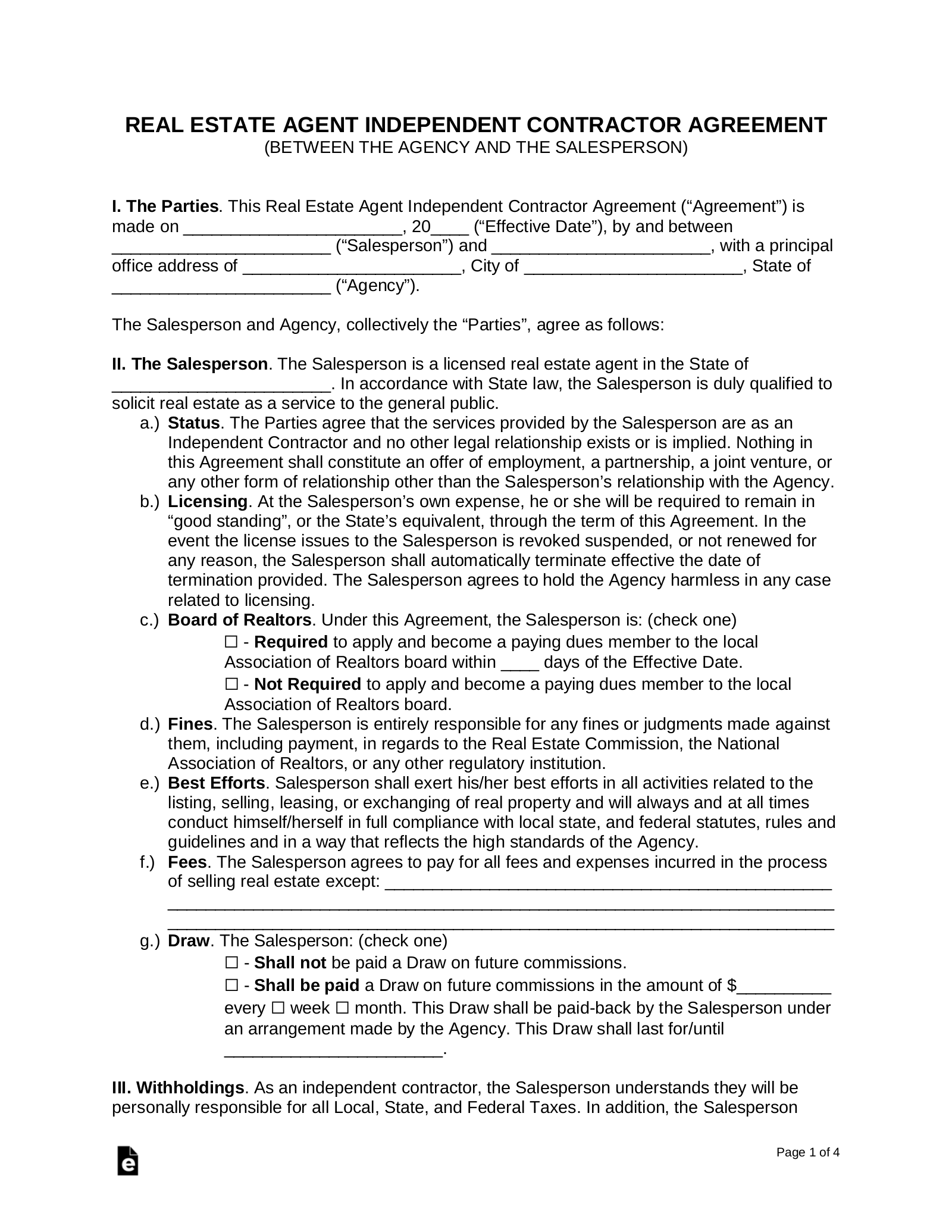

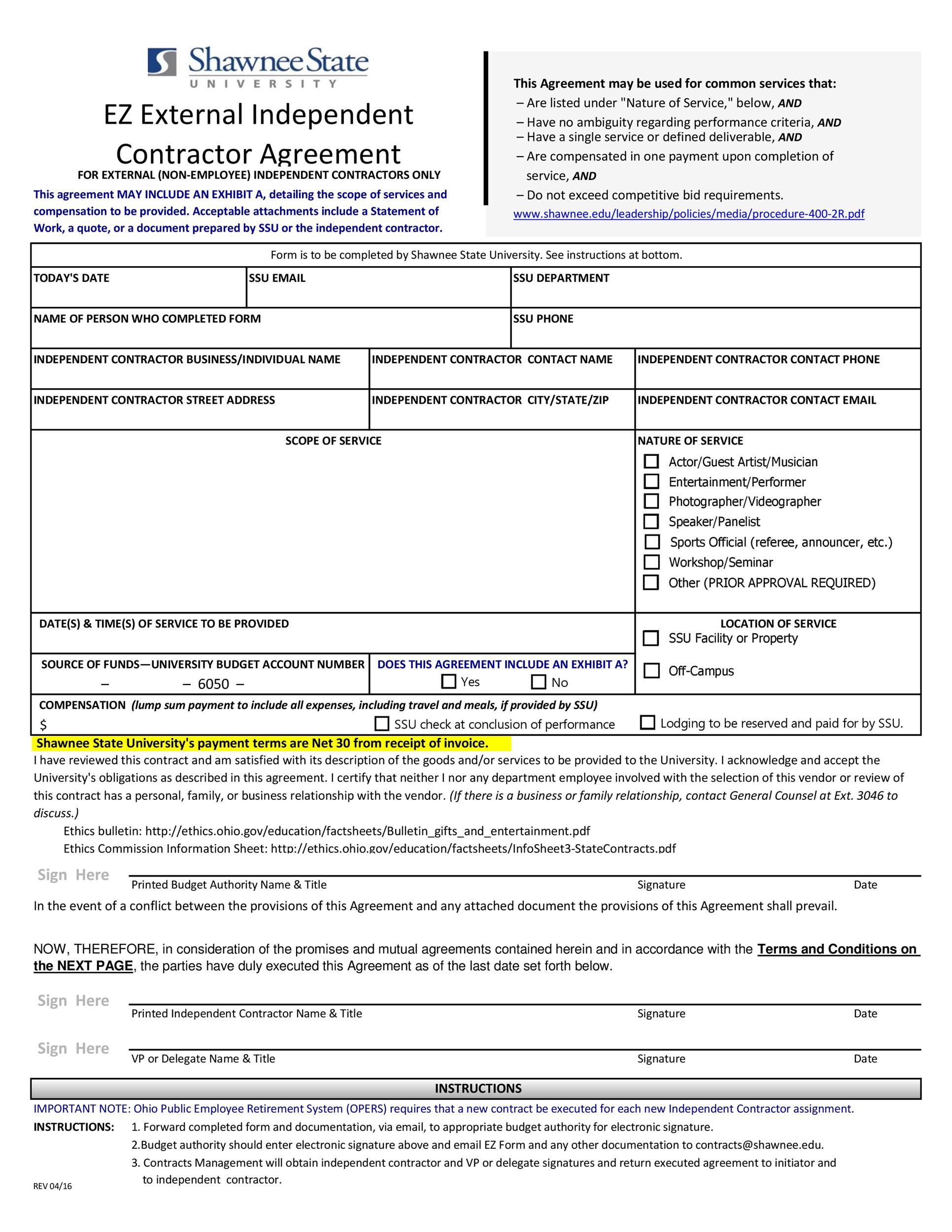

50 Free Independent Contractor Agreement Forms Templates

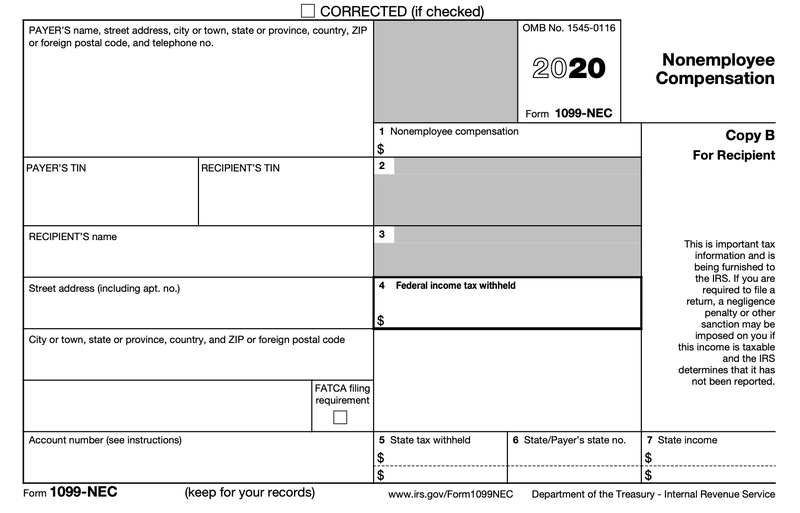

This is a workfromhome (remote), 1099 independent contractor position Pay is hourly (not a commission role) Enter scheduled meetings into sales calendars The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)Workers Compensation Insurance for 1099 Contractors Workers' compensation insurance is a musthave for employers;

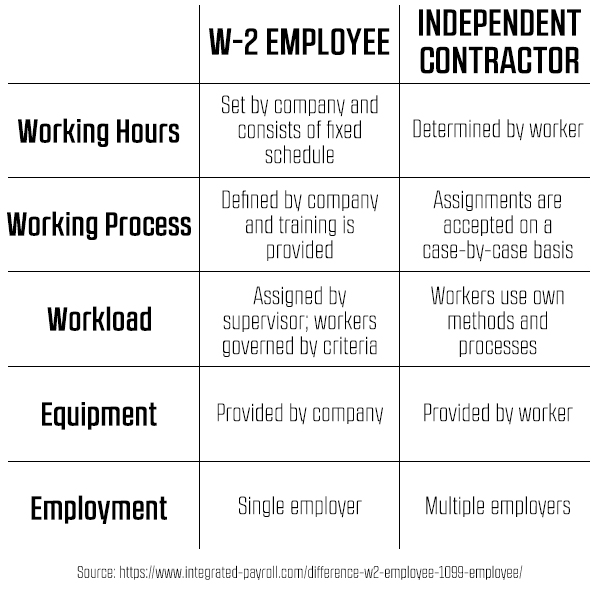

A 1099 contractor is a person who works independently rather than for an employer There are significant differences in the legalities of a contractor and employee While the work can be similar in nature, it is important to follow the law with regard to taxes, payments, and the like Benefits of a 1099 There are many benefits to the 1099 approach, and I prefer it for these reasons You can be hands off The clinician schedules their own sessions, takes payment and turns it in (I have a clear process for this), and uses their own networkOvertime for 1099 Independent Contractors The matter of classification of employees as independent workers and not employees is a move by employers to seek tax benefits at the expense of employees By classifying employees as independent contractors, employees receive 1099 tax forms as opposed to W2's, tax forms used by employees

Microsoft Word Eastmark 1099 SubContractor AgreementDOC Author tmf Created Date Use a 1099 spreadsheet template (Excel or google sheets) Perhaps the best way to track your income and business expense as an independent contractor is through spreadsheets Furthermore, it is beneficial while filling out 1099misc forms Open either Excel or Google Sheets to begin the expense tracking process Independent Contractor Defined People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether these

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

Where Is My 1099 Atbs

A 1099 worker is a selfemployed worker or independent contractor 1099 workers may also be freelancers or gig workers Generally, businesses hire these workers to complete a specific task or work on a specific project as defined in a written contract 1099 workers define for themselves when, how, and where they work 1099 Contractors and Freelancers Most sharing economy workers are 1099 contractors for tax purposes However, you can avoid 1099 contractor status if you formed a corporation for your business The IRS taxes 1099 contractors as selfemployed If you made more than $400, you need to pay selfemployment taxA 1099 form is a tax document filed by an organization or individual that paid you during the tax year "Employees get W2s This is the equivalent of a W2 for a person that

Sfosb Org Modules Showdocument Aspx Documentid

What S The Difference Between W 2 1099 And Corp To Corp Workers

By contrast, 1099 workers are selfemployed independent contractors who receive a set fee or hourly wage based on whatever agreement they have with their client Each 1099 contractor is responsible for covering all benefits, taxes, and Social Security withholding entirely out of Independent contractors — often referred to as 1099 contractors for the relevant tax form — are business owners in their own right Even as sole proprietors with no employees, contractors offer services to businesses based on a contract In most cases, contractors have more than one client, and they set their own work hoursA 1099 contractor, or an "independent contractor", is a legal and taxrelated term used in the US to refer to the type of worker that contracts their services out to a business or businesses Employers face complicated tax issues, claims of misclassification, employee vs

Free Independent Contractor Agreement Free To Print Save Download

50 Free Independent Contractor Agreement Forms Templates

1099 independent contractors are selfemployed freelancers and usually receive payments according to the terms of a contract They report income on their tax return with the IRS by getting a 1099 misc tax form Let's dive deeper into what distinguishes 1099 contractors and W2 employees What is a W2 Employee?In fact, it's the law in every state While it may be clear that you have to carry a policy that covers all employees it can get confusing if you also use independent contractors, also known as 1099 contractors, in your businessIf you are a 1099 independent contractor, suing for wrongful termination, you will need to have the written contract The contract should indicate the relationship you have with the employer and the terms of termination If the employer violated these terms, then

Free Real Estate Agent Independent Contractor Agreement Pdf Word Eforms

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

A 1099 contractor is a separate business entity on its own You are not considered an employee under this contract If you are hired on as a 1099 contractor, you will have a lot of flexibility First, you get to set your own hours, ie you getIf you hire 1099 workers directly, rather than through an employment agency, you will need to set up the following IRS paperwork W9 form 1099NEC form Assuming you pay your contractor more than $600 in any calendar year, you will need to send a copy of the 1099NEC to the contractor and the IRS by January 31561 1099 independent contractor Jobs 50 Transcynd Claim Partners Independent Contractor Assignments (1099) Outside Field AdjusterNationwide CAT/Daily Clearwater, FL $37K $68K (Glassdoor est) Easy Apply 19d Transcynd Claim Partners is a rapidly growing Independent Adjusting & Third Party Administration

Form 1099 Sb Seller S Investment In Life Insurance Contract Editorial Photography Image Of Growth Saving

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice

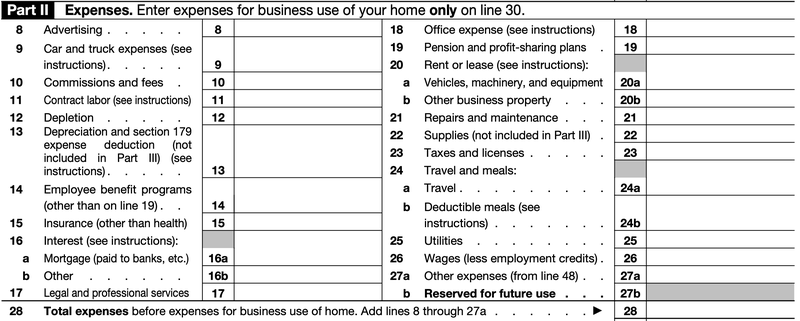

"1099 Reports" shows the 1099 Summary Report just for this contractor This is a preview of the dollar amounts that will appear when you create the Form 1099 for this contractor To edit a contractor Payroll > 1099 Contractors > Contractor List Click the Contractor name You are now on the "Contractor Info" page Click Edit You canThe 1099 tax rate consists of two parts 124% for social security tax and 29% for Medicare The selfemployment tax applies evenly to everyone, regardless of your income bracket For W2 employees, most of this is covered by your employer, but not for the selfemployed! The difference between a 1099 income versus W2 income earner is that a 1099 income earner will be required two years 1099 income history in order to qualify for a mortgage 1099 income versus W2 income mortgage applicants will need to also provide proof that their 1099 income will likely continue for the next three years

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

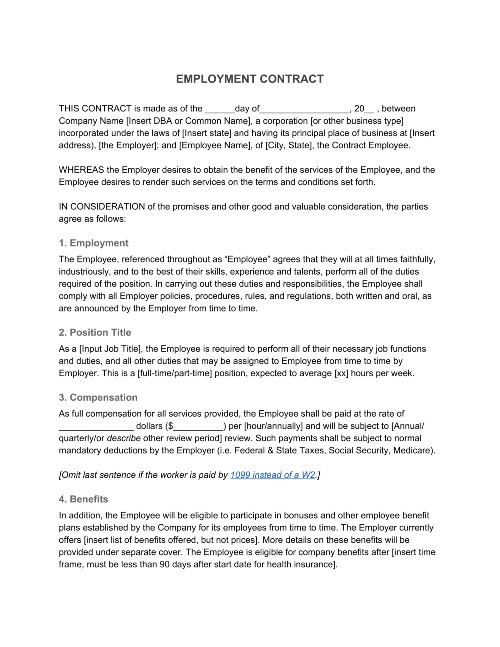

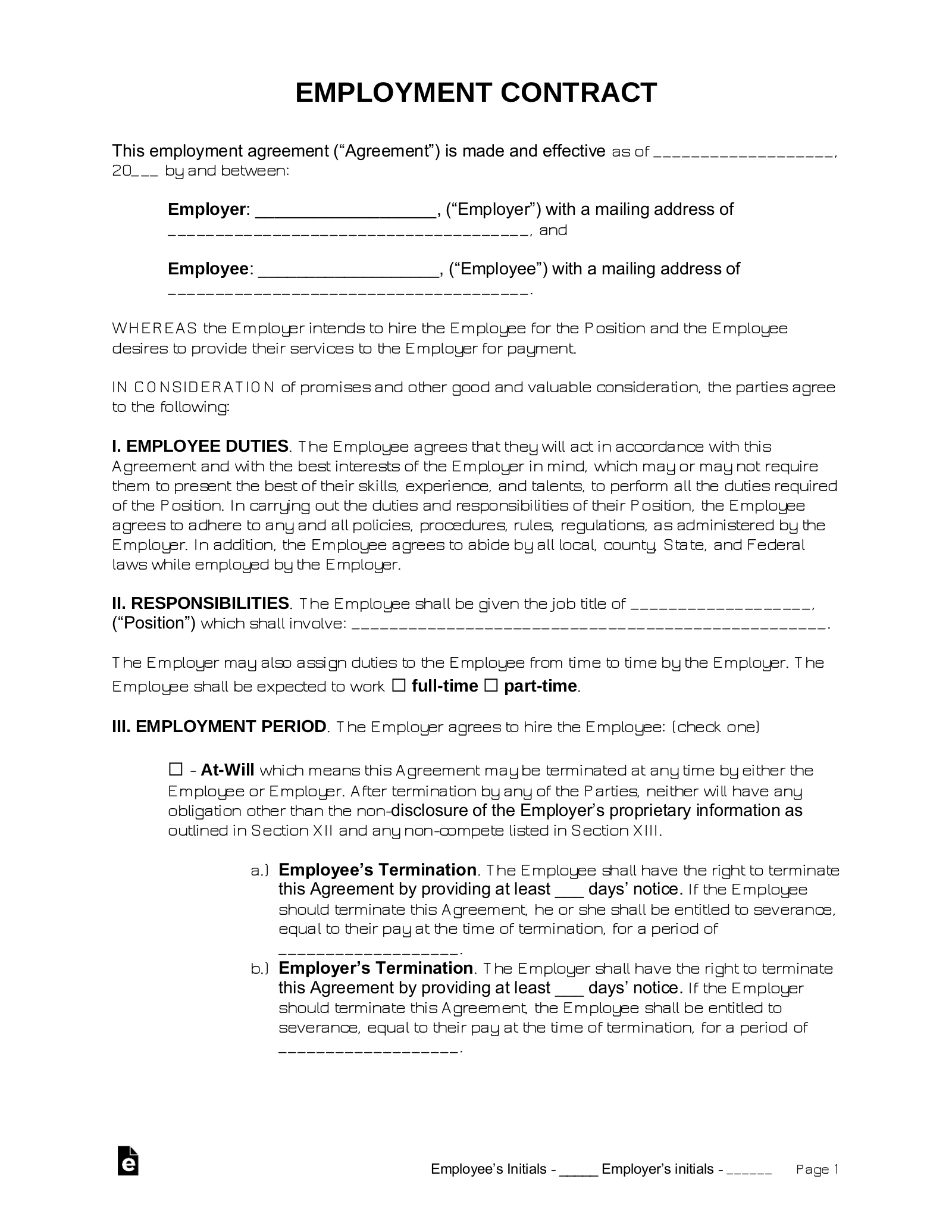

Employment Contract Definition What To Include

While some states require all businesses to have a license, others may require it depending on what kind of work you do62,802 1099 Contractor jobs available on Indeedcom Apply to Driver (independent Contractor), Interviewer, Transcriptionist and more!Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form W2 is used instead) The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

How To Report Section 1256 Contracts Tastyworks

A 1099 contractor is a legal and taxrelated term used in the United States to refer to the type of worker who contracts his services out to a business or businesses These contractors exist in multiple fields — from hospital planners, to marketing consultants, to building contractors, to freelance writers The Bad of 1099's Pulling off the proverbial bandaid, first, let's cover the downsides to accepting a position as a 1099 worker or independent contractor As an independent contractor what you make on the job is the same amount that comes home with you at A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the company

What S The Difference Between W 2 1099 And Corp To Corp Workers

At Csn Edu Sites Default Files Documents Independent Contractor Policy Pdf

For tax year , the Medicare surtax applies to single filers and heads of household whose income exceeds $0,000, married couples filing jointly whose income exceeds $250,000 and married couples filing separately with income of $125,000 or more If as an independent contractor, you expect to owe $1,000 or more in taxes when you file yourProfessional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter What is a 1099 Contractor?

2

Free Independent Contractor Agreement Templates Word Pdf

You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files What Is a 1099 Form?

What Is A 1099 Form And How Does It Work Ramseysolutions Com

What Is Form 1099 Nec

Form 1099 comes in various versions, depending on the payment type It can be required of you if you paid someone $600 or more during the tax year Does an Independent Contractor Need a Business License?

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 Payroll 1099 Employee 1099 Contractor Independent Contractor Payroll Software

How To Become A 1099 Independent Contractor As A Physician Assistant Youtube

Truck Driver Independent Contractor Agreement Best Of 1099 Contractor Form What Is A Misc Form Financial Strategy Center Models Form Ideas

Independent Contractor 1099 Invoice Templates Pdf Word Excel

50 Free Independent Contractor Agreement Forms Templates

Free Subcontractor Agreement Templates Pdf Word Eforms

What Tax Forms Do I Need For An Independent Contractor Legal Io

W2 Vs 1099 Employee Or Contractor Hearth Insurance Solutions

1

Independent Contractor Contract Template Contractor Contract Contract Template Independent Contractor

1099 Contract Employee Agreement

Form 1099 Nec For Nonemployee Compensation H R Block

Free Independent Contractor Agreement Templates Pdf Word Eforms

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Create An Independent Contractor Agreement Download Print Pdf Word

1099 Vs Employee Why The Difference Matters When You Hire A Caregiver Care Com Homepay

Independent Contractor Driver Agreement Pdf Independent Contractor Cargo

A 21 Guide To Taxes For Independent Contractors The Blueprint

Independent Contractor 101 Bastian Accounting For Photographers

1

1

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

50 Free Independent Contractor Agreement Forms Templates

Should I Agree To Be Paid As An Independent Contractor

Infographic Contractor Vs Employee What Is The Difference Milikowsky Tax Law

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Floridarevenue Com Forms Library Current Rts6061 Pdf

Self Employed Vs Independent Contractor What S The Difference

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Template Free Pdf Sample Formswift

Download 1099 Forms For Independent Contractors Unique Independent Sales Agent Contract Fresh 1099 Contractor Agreement Models Form Ideas

Contracting 101 A Crash Course On Becoming A Contractor

Real Sales And Marketing Work From Home Opportunities No Cost No Ml

Au3hy Tjer4x2m

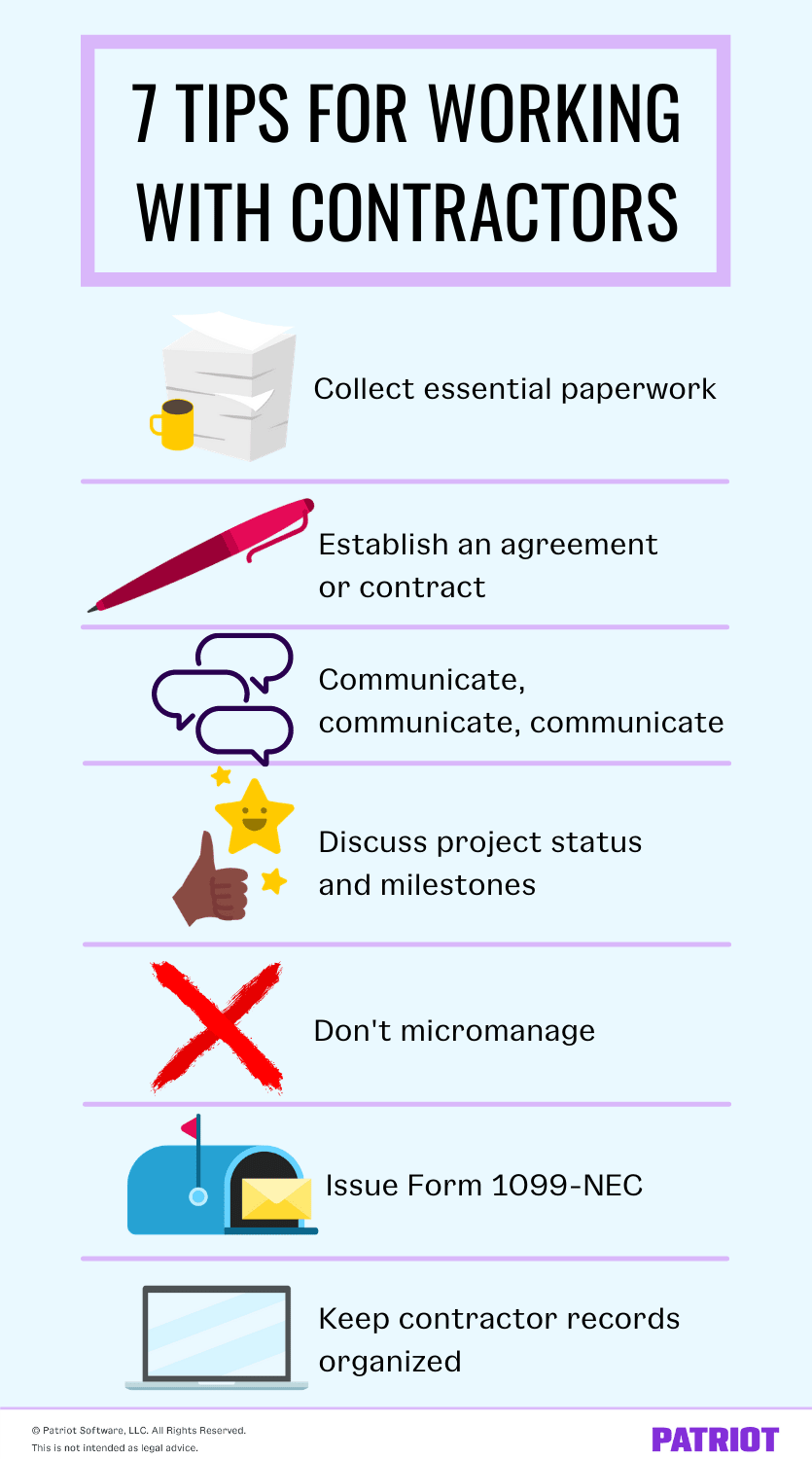

Working With Independent Contractors Business Guidelines

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Independent Contractor 101 Bastian Accounting For Photographers

Employee Versus Independent Contractor The Cpa Journal

Fha Loan With 1099 Income Fha Lenders

Free Texas Independent Contractor Agreement Pdf Word

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

1099 Form Independent Contractor Agreement

Free Employment Contract Templates Pdf Word Eforms

Www Smithcurrie Com Publications California Law Notes 2 Pdf

How To Pay Contractors And Freelancers Clockify Blog

Manoa Hawaii Edu Careercenter Files Independent Contractors Pdf

5 Critical Rights Of 1099 Employee Contract Workers

Is A Contract Employee Always 1099 Quora

Www Oregon Gov Oda Shared Documents Publications Naturalresources factortestforindependentcontractors Pdf

Real Sales And Marketing Work From Home Opportunities No Cost No Ml

Everything You Need To Know About Paying Contractors Wave Blog

Independent Contractor Agreement In Word And Pdf Formats

50 Free Independent Contractor Agreement Forms Templates

Ab 5 And The New Abcs Of Worker Classification Infographic

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

Instant Form 1099 Generator Create 1099 Easily Form Pros

W 2 Vs 1099 Nursing Contracts What Are The Differences Between Them Nphub

A 21 Guide To Taxes For Independent Contractors The Blueprint

Who Are Independent Contractors And How Can I Get 1099s For Free

1099 Vs W2 Pica Pica

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Free Florida Independent Contractor Agreement Word Pdf Eforms

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Employee Vs Independent Contractor Apollomd

Tax Preparation Services Small Businesses Self Employed Or 1099 Contract Workers

Free Independent Contractor Agreement Template What To Avoid

Wrongful Termination For 1099 Independent Contractors Workers Compensation Attorney

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

Deciphering Form 1099 B Novel Investor

A 21 Guide To Taxes For Independent Contractors The Blueprint

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

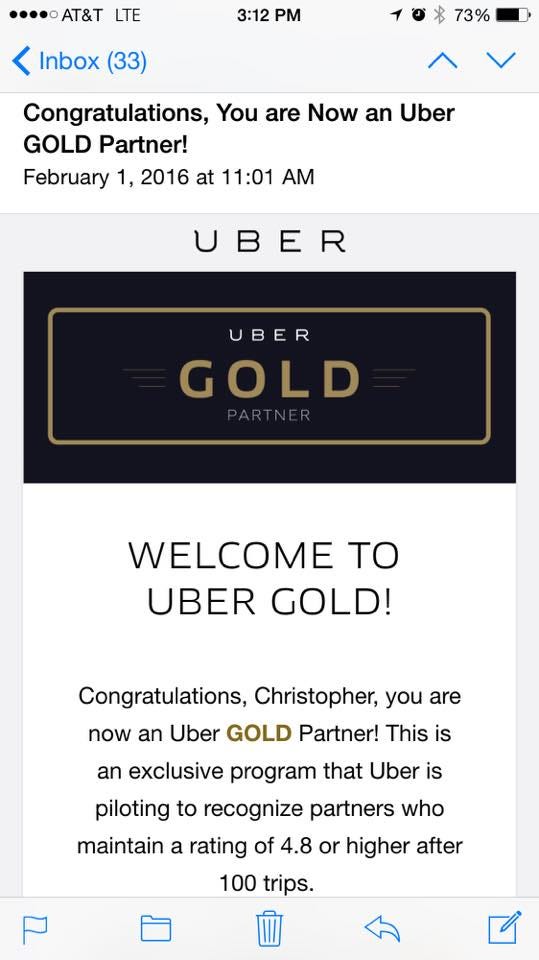

A Severe Disconnect Between Uber Management And Its 1099 Contract Drivers By World Tourist19 Medium

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Tax Form For Contract Labor 1099 Best Of 1099 Agreement Sample Models Form Ideas

50 Free Independent Contractor Agreement Forms Templates

3

Employment Contract Templates W 2 And 1099 Agreements Eforms Free Fillable Forms Contract Template Contract Agreement Contract

1099 Misc Instructions And How To File Square

Free Independent Contractor Agreement Template Download Wise

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice

:max_bytes(150000):strip_icc()/FormW-94-d634d707ffee44839b5a46c998bd71aa.png)

What Is Irs Form W 9

Free Independent Contractor Agreement Pdf Word